Loan Notes – What You Need to Know

Worried About a Loan Note Investment?

Understand the risks—and how to recover your money.

Thousands of UK investors have been misled by unregulated high-return loan note schemes. If you’re concerned about your investment, we can help.

Get Free Advice Now

*Please note that we will not share your details with any third parties.

What Is a Loan Note?

A Simple Breakdown of Loan Notes

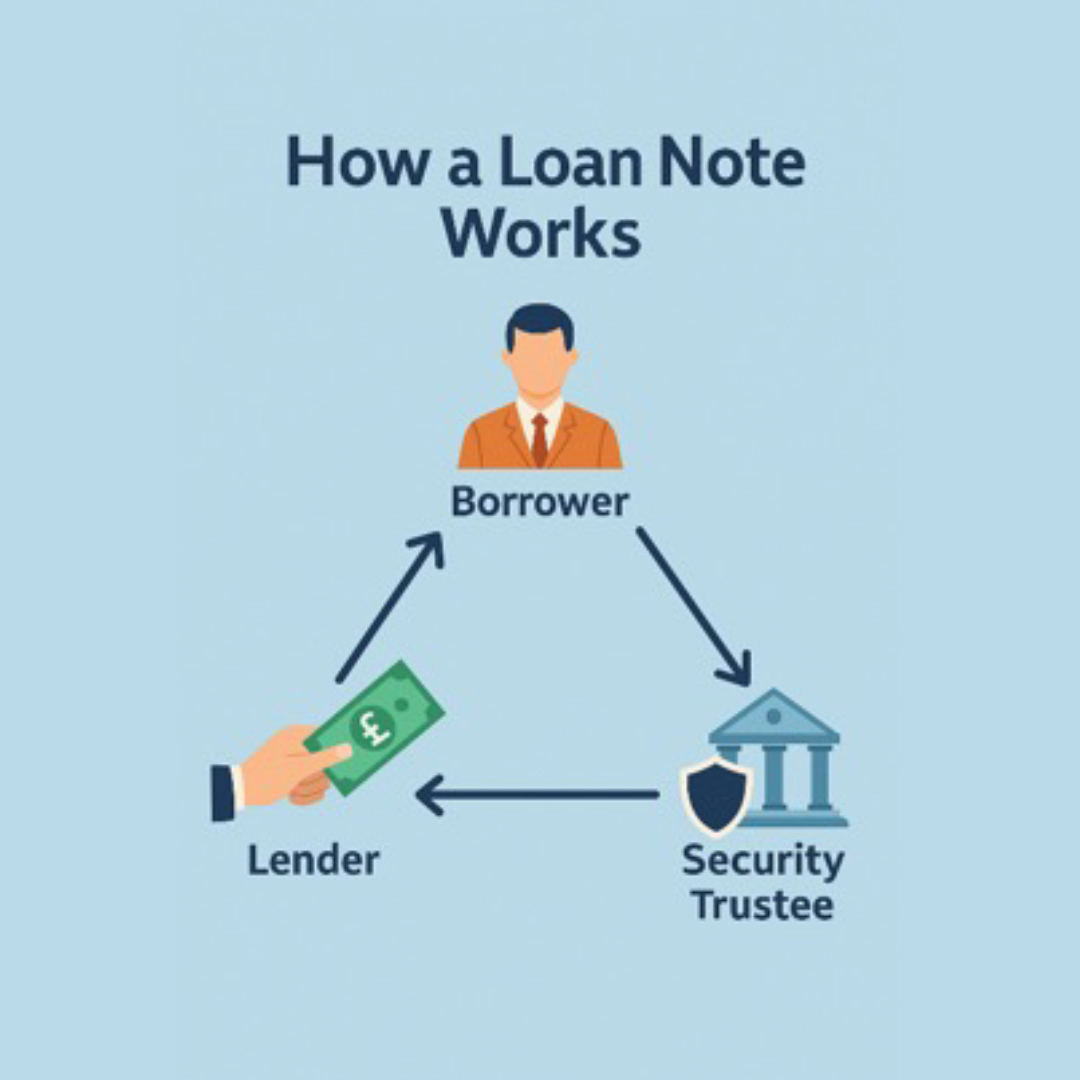

A loan note is a legal agreement between a company and an investor. You lend money, and they promise to pay it back with interest. These products are often promoted with terms like “secured”, “guaranteed”, or “asset-backed”—but that doesn’t always mean they’re safe.

Common Risks of Loan Notes

They Might Look Safe. But Here’s What You’re Not Being Told.

Many are unregulated and sold without FCA protection

Security may be vague or unenforceable

Promoters often exaggerate potential returns

Offshore structures can block recovery

“If something sounds too good to be true, it probably is.”

Have You Been Mis-Sold a Loan Note?

You Might Have a Case—Even If It Was Years Ago

Many investors were mis-sold loan notes by unregulated advisers or firms that made unrealistic promises. If you used your pension or savings and were pressured to invest, there may be grounds for recovery through Insolvency & Law.

Promised fixed high returns

Invested via SIPP / QROPS or savings

Unsure who holds the security

Can’t access or recover funds or interest payments

How We Can Help

Insolvency & Law: Experts in Investment Recovery

Investigate Schemes –

We examine the structure, terms, and company background.

Challenge Directors & Trustees –

Including those who fail to act in your interest.

Represent Creditors –

In claims, and legal proceedings.

Recover Funds –

Through civil claims, asset tracing or insolvency proceedings.