Why chase failed SMEs for unpaid Bounce Back debt?

The Insolvency Service recently announced plans to investigate business owners who close down companies without repaying the government’s Bounce Back Loan Scheme (BBLS) debts.

Considering the chronology of events, and state of the economy, such a strategy seems unjust. Here’s why…

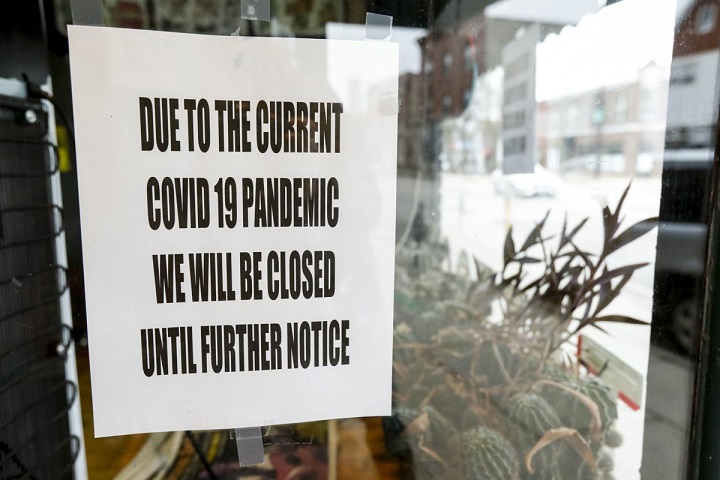

The implementation, abandonment, and then reinstatement of lockdown restrictions caught business owners, and most people, off guard.

In March 2020, businesses in Britain were effectively ordered to stop trading. A month later, the British government introduced the Bounce Back Loan Scheme (BBLS). The scheme aimed to support businesses during the Covid-19 pandemic.

Over the next 7 months, around 1.4m business owners, fearing they might lose their companies, applied.

The government approved around £40bn of BB loans. Some companies survived. Sadly, others failed in 2021 because very few businesses owners anticipated the lockdown would be in place for so long.

With this in mind, it seems harsh to now:

- Punish directors and owners of companies that collapsed during the pandemic

- Accuse them of abusing the BBLS

Investigations of Bounce Back Loan abuse

The director will have to explain their actions if:

- The BBL was all spent

- The company still suffered

But a director has nothing to fear if they can explain how the funds supported the business.

For example, the Insolvency Service may investigate why the proceeds of a £40,000 BB loan were transferred into a director’s personal account in the months prior to the company’s demise.

The director’s behavior will be evaluated in regards to how they:

- Spent the BBL

- Managed the company’s debts

As a result, there should be no recriminations for a director who clearly demonstrates how the loan was transacted through the company to meet everyday expenses such as trade, rent, and salaries.

What Is a Bankruptcy Restrictions Order (BRO)?

When you declare bankruptcy, you enter a 12-month period as an “active bankrupt,” during which you must adhere to a set of restrictions. If you…

Read MoreKingsway Square Limited (In Administration)

Did you purchase an off-plan property with Kingsway Square Limited (In Administration) which has not been developed – would you like your deposit returned? Are…

Read MoreGibraltar Financial Services Commission (GFSC) – Did they fail Loan Note Holders?

As a loan note holder, you may have placed your trust in regulatory bodies such as the Gibraltar Financial Services Commission (GFSC) to safeguard your…

Read MoreGibraltar Financial Services Commission (GFSC) – 100% Asleep at the Regulatory Wheel

Faith in Regulations Insolvency & Law (I&L) recently received confirmation from the Gibraltar Financial Services Commission (GFSC) that Castle Trust and Management Services Limited (CTMS)…

Read More