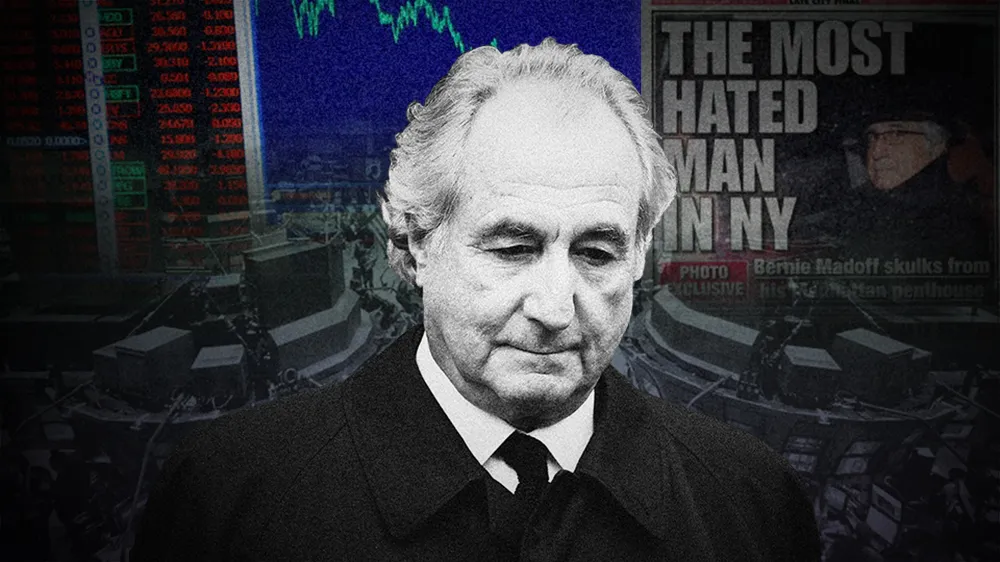

Bernie Madoff and his $64billion Dollar Ponzi Scheme

By now, you must have heard the name Bernie Madoff. The disgraced Wall Street financier and former chairman of NASDAQ who ran the largest scale Ponzi scheme ever known. The scale of it so large, that he has been referred to as a ‘financial serial killer’.

However, he was already an established and successful businessman. The documentary’s director Joe Berlinger said:

“Bernie Madoff is largely responsible for legitimising that market, the electronic exchange, that today Google, Microsoft, Apple are part of. The irony of this is he was a great innovator, and that certainly is why people trusted him. But there were just too many red flags to ignore.”

Despite this, it is frankly astonishing that he was able to keep this scheme running for as long as he did.

How did the Ponzi scheme work?

Madoff operated the scheme through the wealth management side of his business. It was actually a classic and incredibly simple Ponzi scheme. It was the same old story we see time and time again, even up until very recently in the UK. Madoff lured in investors’ by promising them unusually high returns on their investments. Once the money was handed over to him – he just transferred it to his personal bank account. That’s it. It was that simple.

In order to give the scheme an air of legitimacy, he paid ‘returns’ to those earlier investors using money from the more recent ones. Robbing Peter to pay Paul. According to the documentary, no one was really allowed to ask many questions and if they did, Madoff would say he was happy to return their money to them.

Madoff’s victims ranged from widows who entrusted all their money to him to big investors who were supposedly very savvy. He relied on word of mouth to get as many people investing as possible- even famous wealthy people such as Warren Buffett, Steven Spielberg, and actor Kevin Bacon.

Did he act alone?

Let’s be realistic for a second. There is no possible way for a single person to operate such a large-scale fraud alone. He would have had a myriad of professional enablers, most notably- the bank JP Morgan Chase.

The doc also mentions his ‘big four’ investors: Norman Levy, Stanley Chase, Carl Shapiro, and Jeff Picower. Did they know they were funding a Ponzi scheme? They bailed Madoff out of financial trouble many times over. Apparently, Jeff Picower made more money from the scheme than anyone else- including Madoff himself. Do with that information what you will. The fact of the matter is he could not, and did not act alone.

The Aftermath

He was caught in December 2008 and charged with 11 counts of fraud, money laundering, perjury, and theft. Things fell apart when a large number of investors wanted to cash out their investments – to the tune of around $7 billion. Madoff didn’t have anywhere near enough money to cover the requested withdrawals. At the time, he could only manage to come up with a couple of hundred million, which is still a staggering amount of money.

Director Joe Berlinger also said:

“The reality, which is underreported and a cautionary tale for everybody who has any kind of financial assets in the market, is he got away with it because of a whole cadre of literal co-conspirators or people who should have known better.”

The most baffling part is the why? Madoff already had a wildly successful business in the form of his legitimate brokerage business- He and his family were already very wealthy. One can perhaps boil it down to a quote from early in the documentary which stated that Madoff ‘Had a bigger fear of failing than being caught lying’. But at what cost?

In blue collar crime the bodies drop before the investigation. But, in white collar crime- the bodies drop after.

If you think you’ve been the victim of a Ponzi Scheme, call us now on 0207 504 1300.

Scam Alert

This message serves as a warning against potential online scams, including website scams and investment scams. Please exercise caution and conduct thorough research before engaging in any online transactions or investments. Protect your personal and financial information from fraudulent activities, and consult with trusted sources for advice.

Understanding the winding up petition: A crucial tool

In the world of insolvency, a winding up petition holds significant importance. When a company has received a statutory demand (SD) and fails to raise…

Read MoreUrgent Call to Action: Have You Invested in Beech Holdings (Manchester) Ltd?

If you or anyone you know has invested in Beech Holdings (Manchester) Ltd, it’s time to take action immediately and get in touch. The Situation…

Read MoreBankruptcy Annulment: A Fresh Start for Financial Recovery

Bankruptcy is often viewed as a last resort for individuals overwhelmed by debt, offering a path to financial relief but also leaving a significant mark…

Read MoreCastle Trust and Management Services Ltd- The Big Problem for the Gibraltar Financial Services Commission

The collapse of Castle Trust and Management Services Ltd (CTMS) has raised serious questions aboutthe role and effectiveness of the Gibraltar Financial Services Commission (GFSC)…

Read More