Economy

Laws for winding up orders need more clarity

Entrepreneurial small business owners should be overjoyed with Government plans to increase the debt threshold for winding-up petitions to £10,000. The move is in harmony with new protections and laws designed to support businesses. Temporary measures introduced last year under CIGA 2020 will be replaced from 1 October to 31 March 2022. Subsequently, more debtor-friendly…

Read MoreDirectors guilty of BBL abuse face disqualification

A few months back, we protested the Insolvency Service’s decision to chase the owners of failed businesses for failing to repay Bounce Back Loans. However, the findings of a report by the House of Commons public accounts committee suggest the agency’s strategy may be appropriate after all. To help struggling small-to-medium enterprises (SMEs) during the…

Read MoreHardship for 100,000 SME construction firms

Almost 100,000 small to medium-sized enterprises (SMEs) in the construction industry faced serious money problems in the first quarter of 2021, a study by business rescue experts Begbies Traynor has revealed. The findings reveal that in the months leading up to 31 March, 96,067 British SME construction firms had either: County court judgments (CCJs) of…

Read MoreWhy chase failed SMEs for unpaid Bounce Back debt?

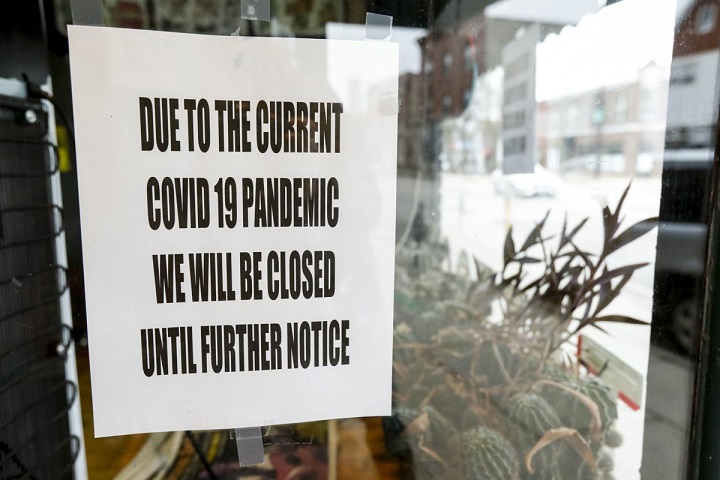

The Insolvency Service recently announced plans to investigate business owners who close down companies without repaying the government’s Bounce Back Loan Scheme (BBLS) debts. Considering the chronology of events, and state of the economy, such a strategy seems unjust. Here’s why… The implementation, abandonment, and then reinstatement of lockdown restrictions caught business owners, and most…

Read MoreTips for bankrupts and bankruptcy in 2021

Considering the state of the UK economy, it should come as no great surprise if there’s an increase in the number of bankrupts and bankruptcy procedures in 2021. In the vast majority of cases, the main causes of bankruptcy are: Loan defaults Unemployment Business failures A downward trend in the economy If you have…

Read MoreLenders may seek aid for Covid-19 losses

Although the UK government’s primary focus must be to maintain and kick-start our ravaged economy, a colossal challenge involving mortgage providers and other lenders looms around the corner. Banks, building societies, and other lenders have loaned out lots of money, and securitised properties, machinery and other assets. Additionally, they have financed the housing market by…

Read More